2022 Year in Review

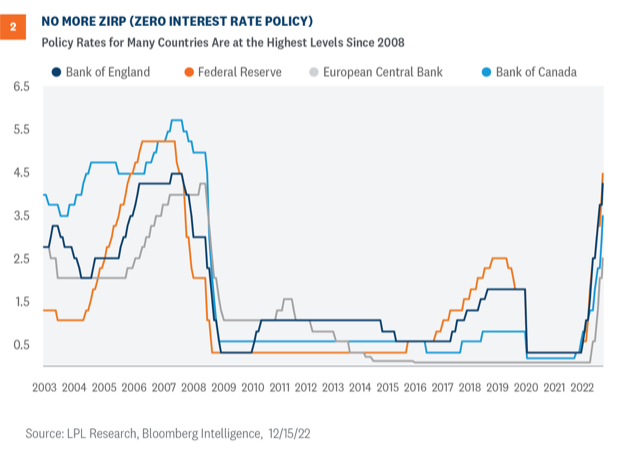

2022 was a challenging year in the markets driven by the Federal Reserve raising interest rates at the fastest clip in over 40 years. These rate hikes brought the Fed Funds rate to its highest level in over a decade. We are officially out of the ultra (artificially?) low interest rate era of the past decade with no indicators of going back. With that have been painful ripple effects across the stock and bond markets this year.

While the Fed isn’t signaling any intent to retract or change course, there does seem to be a consensus that rate hikes will be slowing heading into 2023 with the primary goal of taming inflation. With these factors in play, we were certainly more active with portfolio and investment changes in 2022.

Looking Ahead

Our Investment Strategy

Shorter bond durations, less tech-oriented companies, and a higher focus on consistent dividend payers and outstanding balance sheets continue to be a focus for your portfolios heading into 2023. We believe that having high cash/savings balances and investing in companies with lower leverage and solid earnings history can continue to help weather volatile markets and be positioned well when the markets rebound.

Short term results are difficult, if not impossible to predict (boring but true disclaimer), however we do

believe long term growth from high quality businesses is more predictable. At the same time we

must acknowledge that Fed interest rate and QT policy has a significant impact on the timing and pace of any sustained recovery.

Read more here from LPL Research.

What Else We’re Doing

In addition to portfolio management, here are a few of the other areas of planning focus for us this past quarter:

- Carefully assessing after tax investments for opportunities to take capital loss in a security and replace that security with a higher conviction investment.

- Evaluating Roth Conversion opportunities

- Assessing opportunities for Qualified Charitable Distributions (QCDs) for RMDs to provide above-the-line tax deductions.

- Celebrating Steph’s return to us from maternity leave this week! We missed our Client Services Director immensely and are so glad to have her back (and we know you are also).

What We’re Reading

Lastly, if your new year’s resolution is to read more in 2023, we have a recommendation: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel

“Housel does a great job explaining through everyday stories the unusual ways people use and think about their own money and how important historical context is to the equation.”

Our Process

As you know, we follow a disciplined and diversified asset allocation process to building our portfolios. We believe in long-term investing, not short-term speculation. We lean on our LPL Research team of 50+ professionals for ongoing asset allocation and fund screening. (Remember, LPL offers no proprietary products, which enables us to make objective decisions.) Then, we utilize a secondary screening through Morningstar (a third-party investment research company) for another layer of due diligence.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. Tactical allocation may involve more frequent buying and selling of assets and will tend to generate higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. Stock and mutual fund investing involves risk including loss of principal. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

No strategy assures success or protects against loss.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Securities and Advisory services offered through LPL Financial. A registered investment advisor. Member FINRA & SIPC.

BridgeQuest Wealth Strategies

Cras ultricies ligula sed magna dictum porta. Praesent sapien massa, convallis a Cras ultricies ligula sed magna dictum porta. Praesent sapien massa, convallis a Cras ultricies ligula sed magna dictum porta.

© BridgeQuest Wealth Strategies • Designed by Square Peg Marketing & Branding LLC