You’ve probably heard that it’s best to exercise regularly and often (okay, release the guilt now).

What about when it comes to exercising your company stock options? Is it that simple?

The exact answer of course is “it depends”. That might sound like a boring financial planner, but let’s

break it down.

What is a stock option?

A stock option is the opportunity offered by an employer to an employee to buy a certain number of

company stock shares at a certain price (usually discounted) on or before a certain date.

“Exercising” a stock option refers to taking advantage of this opportunity and purchasing shares.

Stock option plans vary greatly from company to company, and it’s important to read your stock

option plan thoroughly for details.

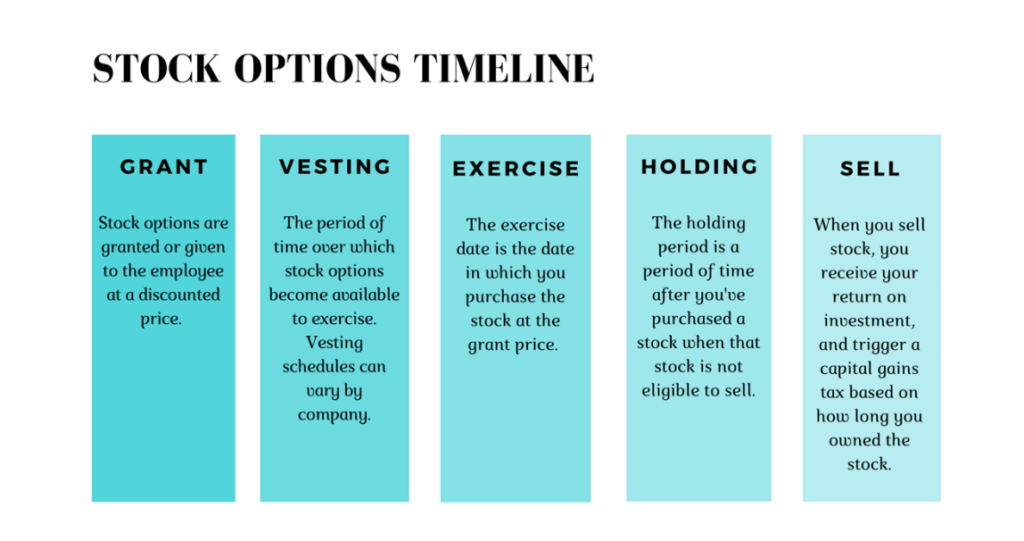

Please refer to the basic timeline and common terms associated with stock options below.

Below are some basic considerations when making decisions about your stock options.

How + When to Purchase

Once a grant is given, the employee has time to decide whether or not to purchase the stock. Here

are some considerations for purchasing a stock option:

- Is it “in the money”? Meaning, has the value of company stock increased from the discounted price given to you by the employer? If so, you are “in the money” if you purchase the stock at the discounted grant price. If the market price is lower, then the stock is “out of the money”, and you wouldn’t exercise the stock option. Monitoring the current market value of your company’s stock is important during the vesting period.

- Be cognizant of the expiration date. If the stock option is “in the money”, it’s important that you purchase the stock before the expiration date and not let the valuable stock option expire.

How + When to Sell

When should you sell your stock in the company? Here are some considerations for selling your

stock:

- Evaluate the tax implications. Selling stock you’ve owned for less than a year will trigger short-term capital gains. Selling stock you’ve had for longer than a year will trigger long-term capital gains, which is more favorable.

- How does this fit into the rest of your financial plans and needs? This might require a deep dive into your personal finances. Will you need this money in the next few years for something such as college tuition or home improvement?

- Consider how much of your livelihood depends on one company. Having too much of your stock or net worth in one company could be disastrous if the company stock decreases or the company goes bankrupt. Have a selling strategy for your company stock and diversify your stock portfolio to give you confidence.

Stock options are great way to buy stock at a discounted price and build wealth for the future. To

exercise or not to exercise, like so many other significant financial decisions we face in life, should

be a thoughtful and intentional decision. Don’t go alone, or make a decision based on a whim or a

colleague’s opinion.

This article does not cover the specific details of stock option plans; it only serves as a basic

overview for readers. Each employer plan is different. It’s important to have a Certified Financial

Planner guide you through this process and clarify factors unique to your specific employer plan and

personal tax situation.

Matt is a Certified Financial Planner® professional and Co-Founder of BridgeQuest Wealth

Strategies. His primary focus is strategic investment planning for individuals and families

nearing a transition point in their lives. He thrives on connecting, strategizing, and

formulating a customized solution for each client.

Contact

BridgeQuest Wealth Strategies

Office: (913) 276-7110

Fax: (913) 276-7119

11900 West 87th Street Pkwy

Suite 130

Lenexa, KS 66215

info@bridgequest.com

Check the background of your financial professional on FINRA’s BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named representative, broker – dealer, state – or SEC – registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Copyright 2022 FMG Suite.

Check the background of your financial professional on FINRA’s BrokerCheck.

Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services are separate from and not offered through Commonwealth Financial Network.

The Financial Advisor(s) associated with this website may discuss and/or transact business only with residents of states which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state. Please check Broker Check for a list of current registrations.

Information presented on this site is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any product or security.

Form CRS