Should You Consider a Roth Conversion?

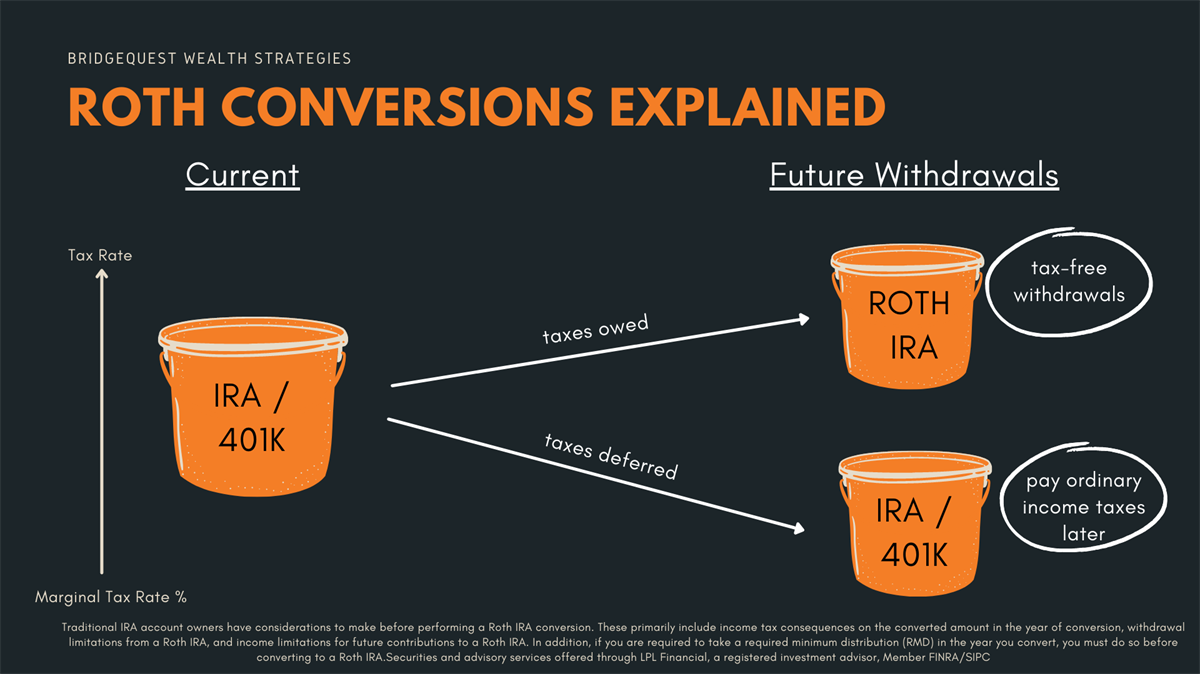

A Roth conversion refers to the process of moving money from a traditional pre-tax retirement account (IRA or 401K) into a Roth IRA account.

This process triggers ordinary income taxes in the year of conversion.

So, why would you want to trigger more taxes in a year than needed? The answer is simple: So that you pay less taxes in the long run, and enjoy tax-free withdrawals in retirement.

No one exactly knows how tax rates could change over the next 5, 15, or 20 years. However, with proposed future tax rate increases and the Tax Cuts & Job Act sunsetting in 2025, Roth conversions are a fairly hot topic.

If you believe your current marginal tax rate is lower than your future rate, then a Roth conversion should be considered. You can pay conversion taxes while you’re in a lower tax bracket and enjoy tax-free Roth IRA withdrawals later.

Let’s look at three examples of when you might consider a Roth conversion:

- Early retirement age, before social security and retirement withdrawals – if you are at a lower income tax bracket and could benefit from paying the taxes now rather than when their income is increased by retirement withdrawals and their social security begins. This is especially effective when the individual has a tax-efficient pool of funds in addition to retirement accounts to draw from.

- Normal Retirement age, before RMDs begin (age 72) –If you aren’t drawing your retirement and have other income sources such as cash-value, life insurance, or after-tax investments, you might consider a Roth conversion to pay taxes at a lower marginal bracket. Additionally, RMDs only apply to traditional IRAs, meaning there’s no yearly withdrawal requirements on Roth accounts. You can watch your money grow tax-free for longer and provide tax-free estate transfer.

- Low-income year – If you’ve experienced an income shift in the past year, such as a job transition or sabbatical, you’re likely at a lower income tax bracket. Paying conversion taxes now could help you pay less taxes in the long run when your income is higher. Often times, Roth conversions are overlooked in these years of significant change, because there are so many other important decisions to make.

In summary, we encourage you to have the “Roth conversion” conversation with your trusted financial and tax professionals, especially if you are in or nearing a year of transition.

Disclosures: Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC

BridgeQuest Wealth Strategies

Cras ultricies ligula sed magna dictum porta. Praesent sapien massa, convallis a Cras ultricies ligula sed magna dictum porta. Praesent sapien massa, convallis a Cras ultricies ligula sed magna dictum porta.

© BridgeQuest Wealth Strategies • Designed by Square Peg Marketing & Branding LLC